The IRS has indicated that the tax bracket ranges and the standard deduction limits will be higher for the 2022 tax year due to the rate of increase in inflation. The rate of increase in consumer prices have caused all tax bracket thresholds and related parameters in the tax code to rise at a faster than normal rate.

Standard Deduction and Other Changes for 2022

The standard deduction for those filing married and jointly increases to $25,900 for 2022, up from $25,100 in 2021. For single taxpayers the 2022 standard deduction is $12,950, up from $12,550 in 2021. Increases in the standard deduction serve to raise the threshold for taxpayers to be able to itemize deductions.

The personal exemption will increase to $12.06 million per person from $11.7 million in 2021. While there was talk at one point about reducing the personal exemption, it will increase for 2022. This can have implications for your estate planning strategies.

The annual gift exclusion will increase to $16,000 from $15,000 for 2022. This is the amount each person can gift to anyone of their choosing without having to complete an estate and gift tax return.

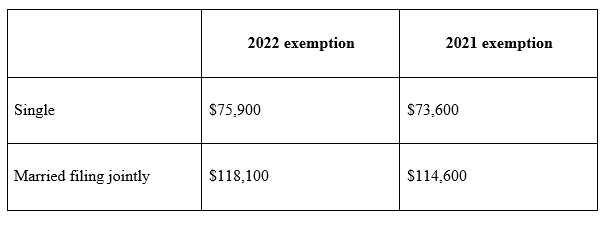

The alternative minimum tax exemption amounts for 2022 have changed as well.

Taxpayers who trigger the AMT typically lose certain deductions and other tax breaks.

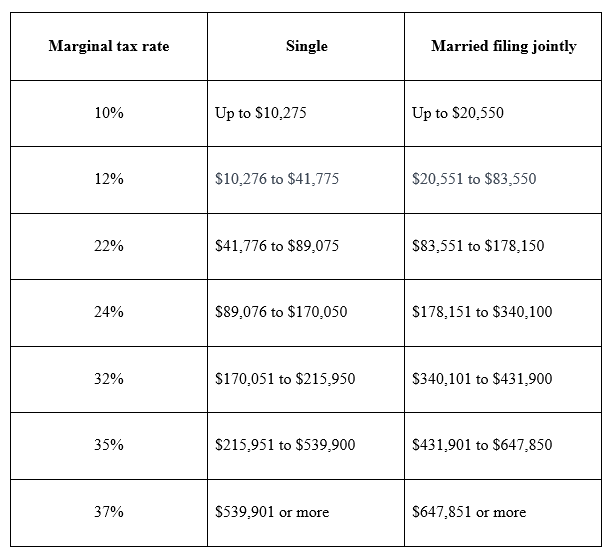

Tax Bracket Changes for 2022

The marginal income tax rates for 2022 are:

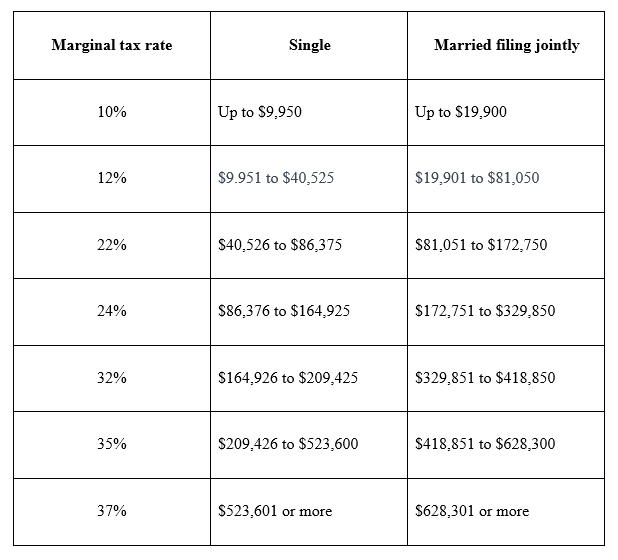

This compares to the marginal tax rates for 2021:

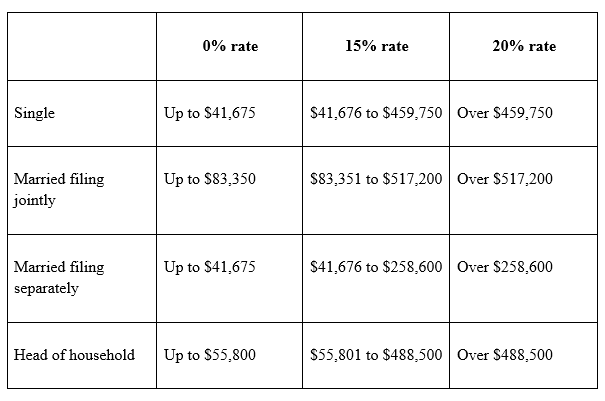

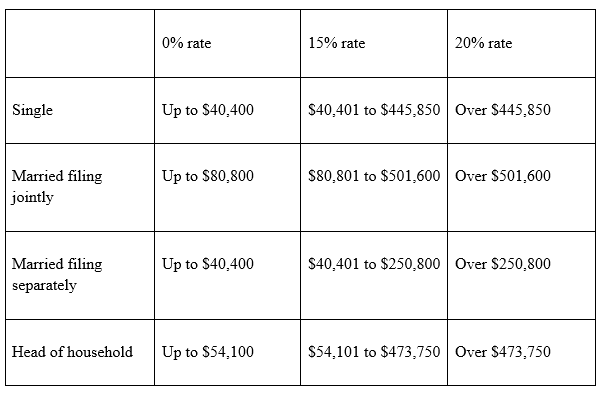

The brackets for long-term capital gains tax rates have also increased for 2022. Here are the brackets for 2022 showing income levels tied to long-term capital gains rates:

The brackets for long-term capital gains rates have been bumped about 3.1%, that same increase as with the regular income tax brackets.

Note that taxpayers who reach a certain income threshold will be subject to an additional 3.8% in long-term capital gains taxes called net investment income tax or NIIT. The income threshold for NIIT varies based on your filing status.

According to Ron Lefton, Managing Director, Investments for Wedbush Securities in Newport Beach, California, “Rising tax rates, along with an increased standard deduction, is an expected consequence stemming from a large amount of government stimulus being pumped into our economy. The IRS has the authority to make annual changes to income, deduction and credit provisions due to inflationary pressures. We have seen inflation growing this year so I expected these increases.”

He adds, “Knowing these changes in advance may help advisors coordinate the 2022 plan of attack with clients and their tax preparers. Although tax ramifications are an important aspect of the investment advisory process, building the best investment plan for our clients is always our main priority.”

How to Prepare If You’re Expecting Major Changes

The end of the year is a good time to not only do year-end tax planning for the current year, but to look at your tax situation for 2022. Will things be changing? Do you plan to leave your job and become self-employed? Are you getting married or expecting a child? Do you anticipate that your income will change up or down in 2022?

These and other factors can impact your tax and investment planning for 2022. This is a good time to consult your Wedbush financial advisor and your tax advisor to be sure you’re planning for 2022 is on track.

Looking to build a financial plan based on your goals while considering market trends and risk factors? Click here to check out our approach to Wealth Management.

Disclosure

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice.