The IRS recently announced an increase to the 401(k) contribution limits for 2022. The 2022 contribution limit will be $20,500, up from $19,500 for 2021. For those who are age 50 or over at any point in 2022, they will be able to add an additional $6,500 in catch-up contributions bringing their total limit to $27,000.

This new limit is effective for all contributions made on or after January 1, 2022.

Impact on Other Retirement Plans

Beside 401(k) plans, the new $20,500 contribution applies to:

- 403(b) plans

- Most 457 plans

- The government’s Thrift Savings Plan

SIMPLE IRA plans will see an increase of $500 in the contribution limit to $14,000. The catch-up contribution limit remains at $3,000 for those who are 50 or over.

The increased contribution limit on 401(k) plans also extends to Solo 401(k)s, a plan that is commonly used by those who are self-employed.

One popular retirement plan that did not see a contribution increase for 2022 was IRAs. This includes both traditional IRAs and Roth IRAs. The 2022 contribution limits remain at $6,000 with a $1,000 catch-up contribution limit for those who are 50 or over.

One type of IRA that will see a contribution increase is the SEP-IRA, a type of retirement account generally used by those who are self-employed. The maximum contribution is based on 25% of your compensation for the year which is unchanged for 2022. However, the maximum contribution for 2022 will increase to $61,000, up from $58,000 in 2021.

How This Can Benefit Those Who Are Employed

Ron Lefton, Managing Director, Investments for Wedbush Securities in Newport Beach, California says, “This is a great thing for all employees who have access to a 401(k) plan. Allowing for additional pre-tax savings will help more people prepare for retirement along with potentially decreasing their annual amount of tax owed.”

He adds, “Over time, tax deferred compounding is one of strongest ways to create wealth. I encourage my clients to maximize their 401k contributions as early as possible in their career as the tax deferred growth over time combined with any amount of employer match can lead to a large retirement nest egg years down the road.”

A 401(k) or similar employer-sponsored defined contribution retirement offers an easy and painless way to save for retirement for employees. Contributions are made directly from your paycheck and the money is generally not missed. Many employers offer a matching contribution which is essentially “free money” that can help employees accumulate even more for retirement.

Good News for IRAs

Even though the contribution limits themselves will not change for IRAs in 2022, there will be an increase on the income limits for pre-tax contributions to traditional IRAs and for Roth IRA contributions in 2022.

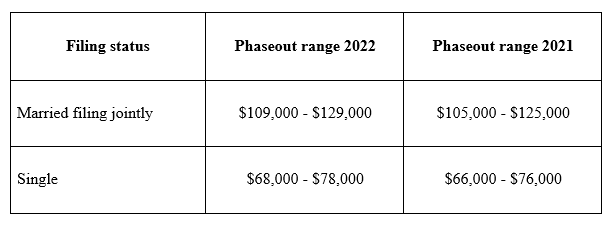

For traditional IRAs, the income phaseout range where those who are covered by a 401(k) plan or similar retirement plan will increase in 2022. The modified adjusted gross income (MAGI) limits are:

Note there are additional phaseout ranges for situations where the spouse making the contribution is not covered by a workplace retirement plan, but their spouse is, and for taxpayers who file as head of household. There are no contribution restrictions for those who are not covered by a workplace retirement plan.

For those whose income is at or above the upper limit, they cannot make pre-tax contributions to a traditional IRA. There are no income limits for after-tax contributions to a traditional IRA.

Regarding Roth IRAs, Jeff and Scott Olsson of Olsson Investment Group in Grand Rapids, Michigan says, “We discuss the advantages of Roth IRA accounts on a regular basis, with clients and prospects. We lay out a simple framework for investing. We suggest to our clients that they have 3 buckets of money-taxable, tax-deferred, and tax-free. The Roth IRA account being the most common account type in the tax-free bucket. With the possible future increase in personal income tax brackets, the Roth IRA account is even more attractive.”

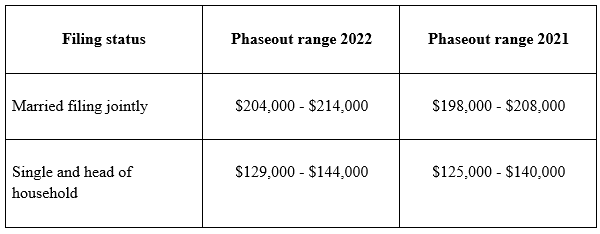

For Roth IRAs, the income phaseout range will increase in 2022. The modified adjusted gross income (MAGI) limits are:

For those whose income is at or above the upper limit, they cannot contribute to a Roth IRA.

For those who want to contribute more to a Roth account or whose income is too high for a Roth IRA contribution, a Roth 401(k) contribution might be a good option if their employer’s plan offers this option. The contribution limits are the same as for traditional 401(k) accounts and there are no MAGI restrictions.

Year-end is a good time to assess where you are in terms of saving for retirement and to make sure you are maximizing tax-advantaged options such as a 401(k) or an IRA. Contact your Wedbush financial advisor to discuss the new contribution limits and all retirement planning options.

Looking to build a financial plan based on your goals while considering market trends and risk factors? Click here to check out our approach to Wealth Management.

Disclosure

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice.